Taxglobal

Project - Design a platform that caters tax service providers and service seekersProject Type - Web appDuration - 16 months (2022-2024)Role - Product Designer

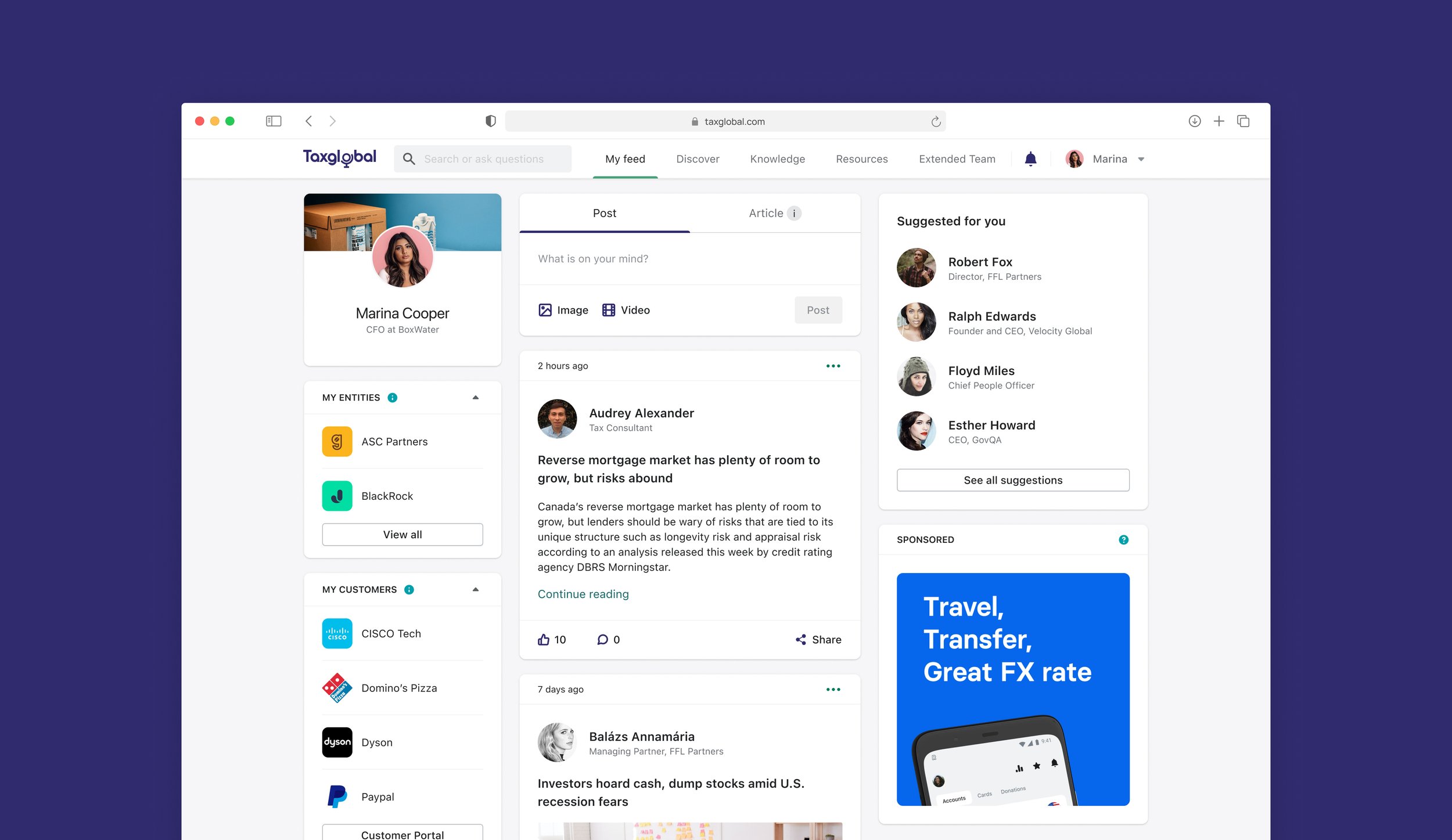

Taxglobal is an online platform that aims to connect potential clients with tax service providers in the United States. It functions as both a networking platform and an online tool for tax professionals.

The goal of Taxglobal is to be one destination for all tax needs globally. Its mission is twofold: to connect individuals with the right tax experts and to match tax experts with suitable clients, fostering success for both parties. Providing every user access to the best tax resources, including the growing technology of AI and machine learning.

Problem

The tax system and industry in the United States are complex, and mistakes can be costly. However, there's a lack of accessible tools for obtaining tax services and knowledge. Recognising this issue, the client aimed to create a platform connecting tax professionals with individuals seeking expertise or professional assistance.

Initial concept

The client wanted a platform similar to LinkedIn but tailored for this specific need. LinkedIn is widely used among professionals, so they aimed to make this platform as close to LinkedIn as possible. This approach would help users who have previously used LinkedIn feel comfortable. The goal was to attract users through a familiar setup while offering a unique set of services.

Initially, the concept was limited to the networking aspect plus basic functions for service providers, such as creating a business presence and lead generation.

Design process

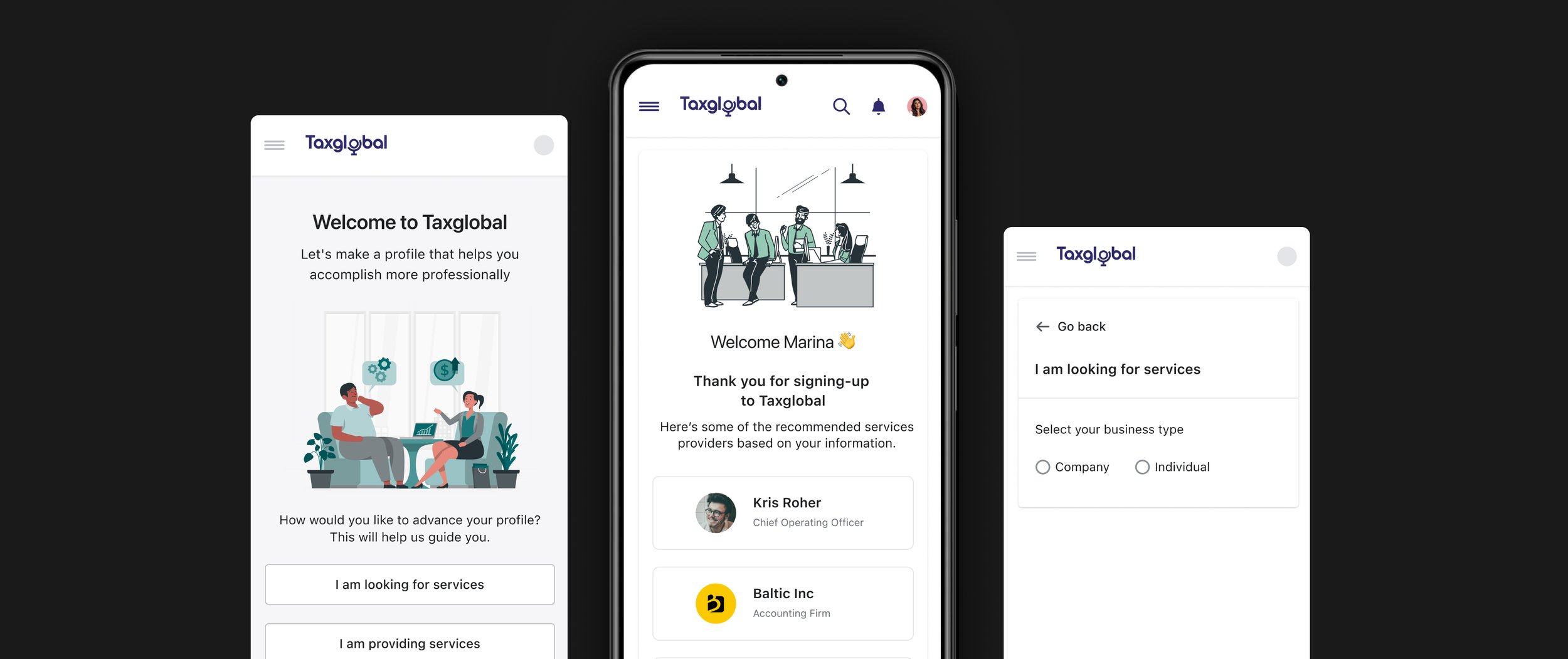

The design process for this project began smoothly due to the straightforward requirements and clear understanding of what needed to be designed. We identified that the majority of the target user base for this product would be in the 35–50 age group, with most service providers working full-time in this field. This insight clearly indicated the need for a responsive web app rather than a native mobile application.

Wireframes and prototype

A notable part of the wireframing process was the onboarding. One of the product's main features was an AI-powered matching algorithm. To generate accurate results, we needed to collect extensive information from every user who signed up. However, a lengthy form-filling process would have slowed down the adoption rate. Therefore, I had to prototype several wireframe versions to determine how to break down the process into manageable pieces and identify which parts were crucial versus which could be skipped.

Design system

To build the design system for this product, I used Shopify’s Polaris design system as the foundation. Polaris was a great choice of design system at the point, due its scalable design and the availability of developer resources.

First version and findings

The first version received significant attention and feedback. This product proved particularly interesting as user feedback from the initial release completely shifted its direction.

We discovered that tax service providers face a common challenge: they need not only a platform to find customers but also dedicated tools to perform their work.

User research

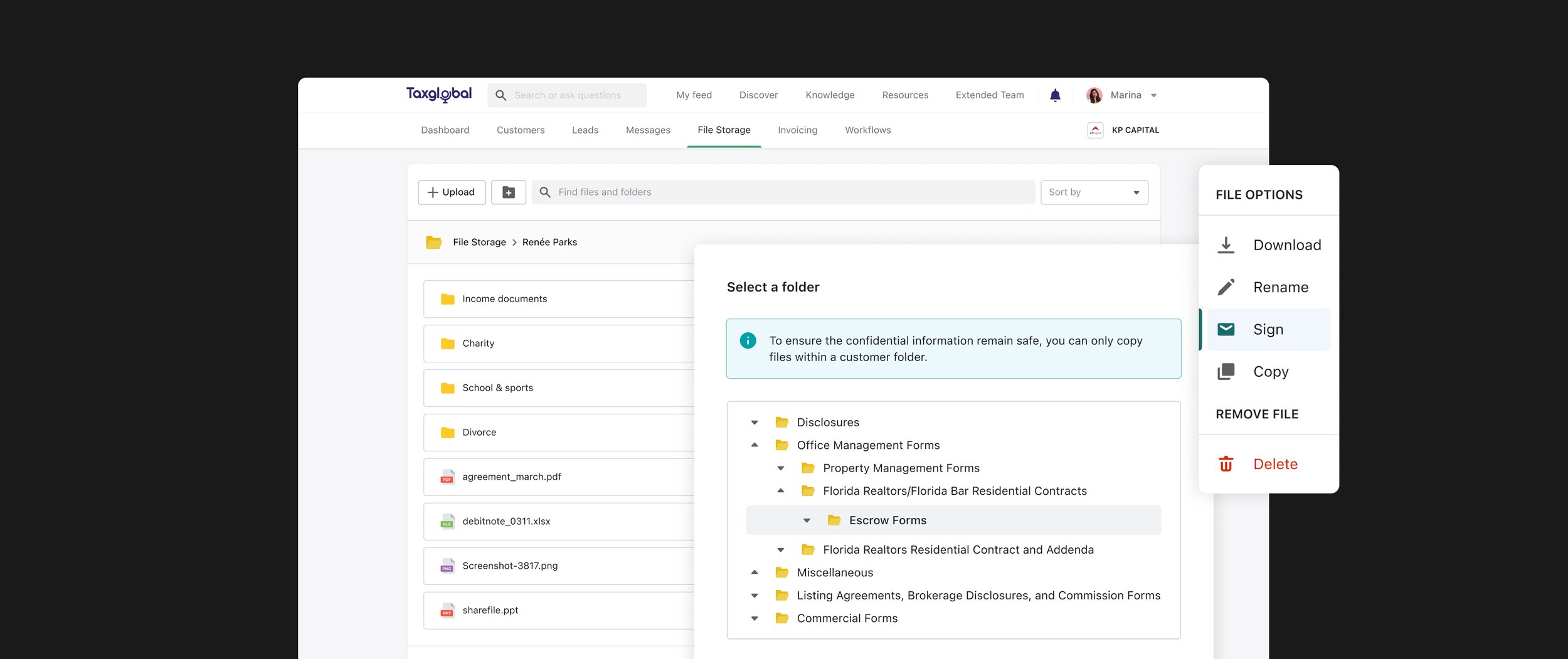

One of the main problems both parties encountered was the volume of documents that needed to be shared. Each service provider had their own methods for sharing and storing these files; however, there was no tool that truly worked well for them.

Another issue was team management. Their work involves complex workflows, and there was interest in a tool that could partially automate this process.

Competitive analysis

While examining the competitive landscape, we discovered that existing software primarily catered to the final stages of service provider workflows. However, there was a notable lack of tools assisting with the early stages, where most of the groundwork is required. These initial tasks were largely performed manually.

In light of these findings, we decided to pursue partnerships with existing products that offer APIs, while focusing our efforts on developing solutions for the underserved areas of the workflow—those crucial early stages where no other products were present.

Solution

We designed a product that functions not only as a networking platform but also as a comprehensive tool for service providers.

File manager

A feature where service providers could securely request files and store them in the cloud. Taxglobal automatically sort and store the files according to each request and workflow that is ready to be used for the next steps.

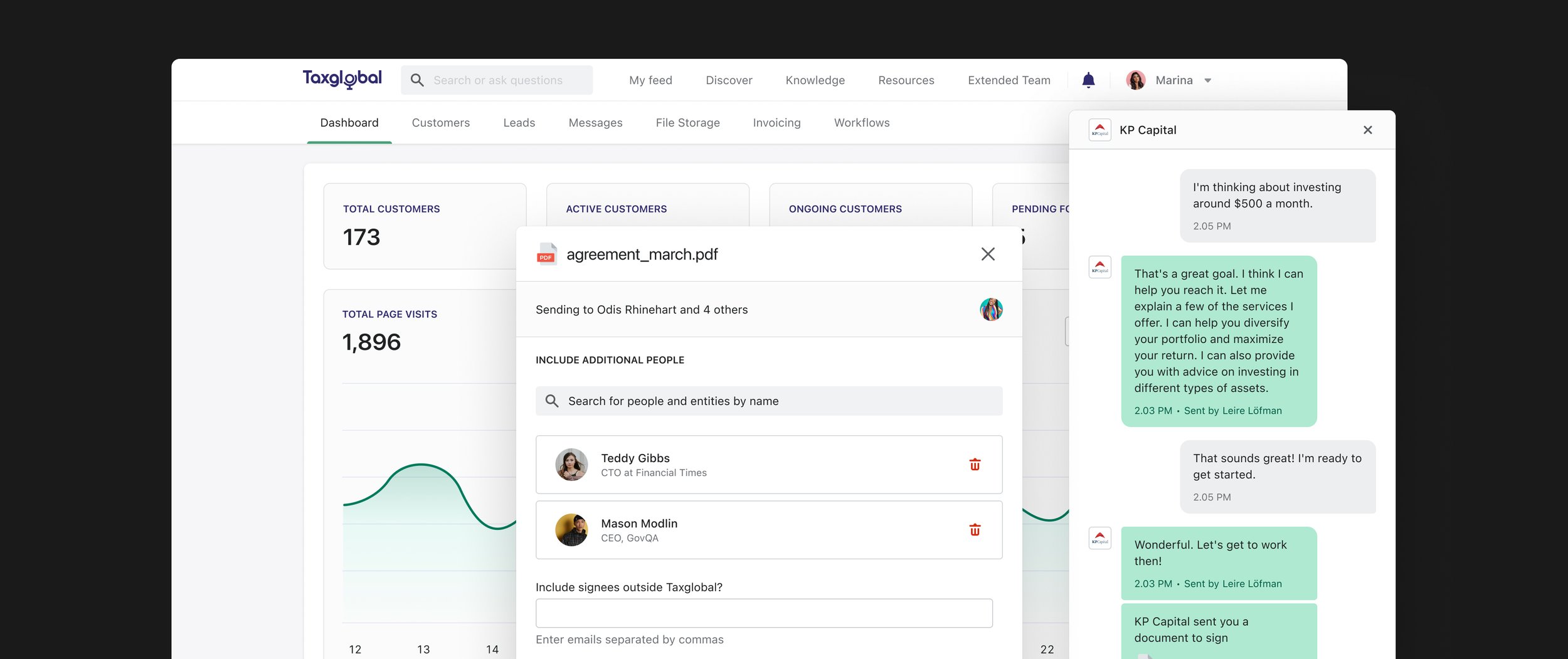

Customer/client portal

A dedicated section where service providers and service seekers can interact and efficiently manage their work. Includes features such as messaging, allowing for instant communication and quick resolution of queries; file sharing functionality, enabling both parties to easily exchange necessary documents and information; and a secure document signing feature, to enable the process of finalising agreements and contracts.

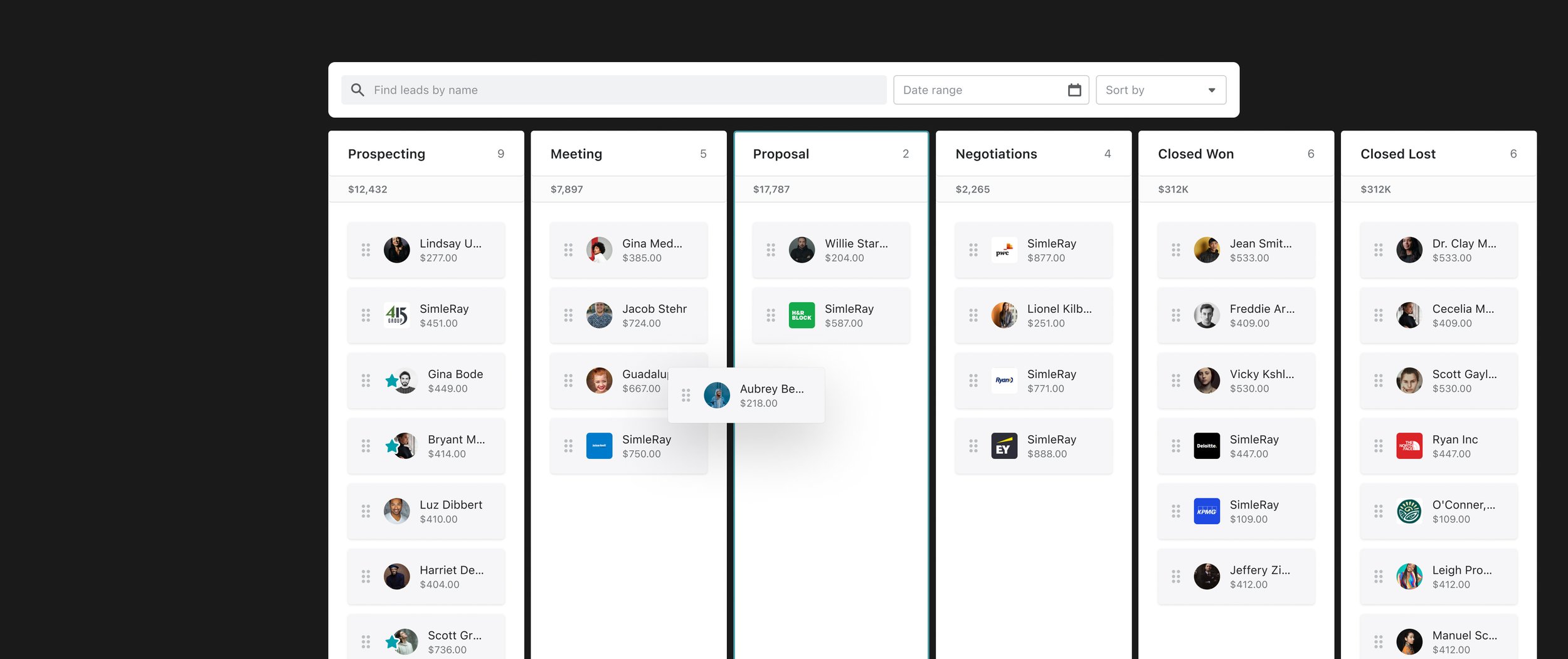

Task management

Although many third-party tools already exist in this area, we wanted to keep users on the platform throughout the process. To address team and task management, I designed a simple kanban board that allows users to stay up-to-date on tasks and assign them to team members.

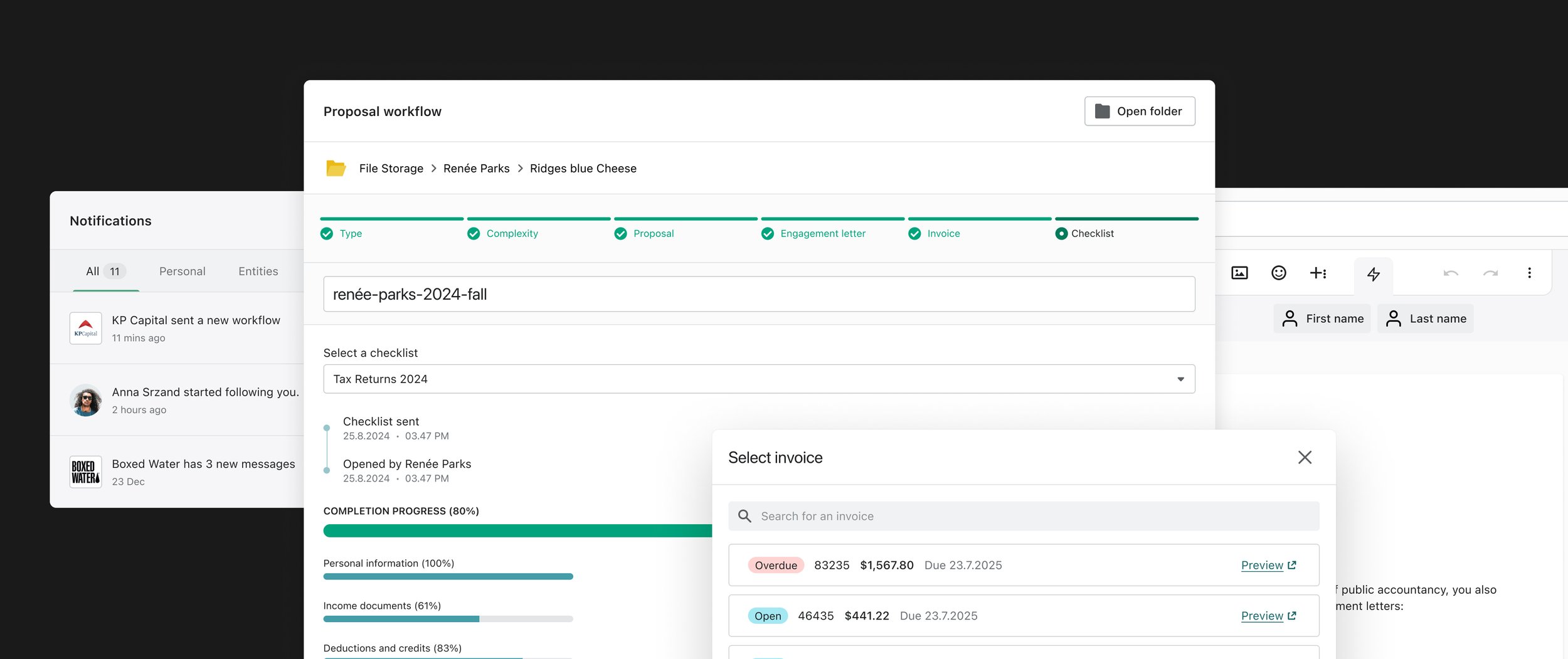

Workflows

Our findings showed that the most time-consuming part of the manual process was keeping track of each client and their workflows, given the complexity involved. To address this issue, I designed a workflow feature that automates each step of the process. It sorts the documents and information collected at each stage, preparing them for immediate processing. Additionally, this feature sends timely reminders to all parties when action is required.

Invoicing

Every service provider already had their own invoicing system in place. However, to build a proper workflow feature, we had to incorporate an invoicing module. We discovered that the most prominent tool for invoicing was QuickBooks. Therefore, we created an integration that allows Taxglobal to leverage QuickBooks' invoicing for those who didn't want to move their invoicing to Taxglobal.

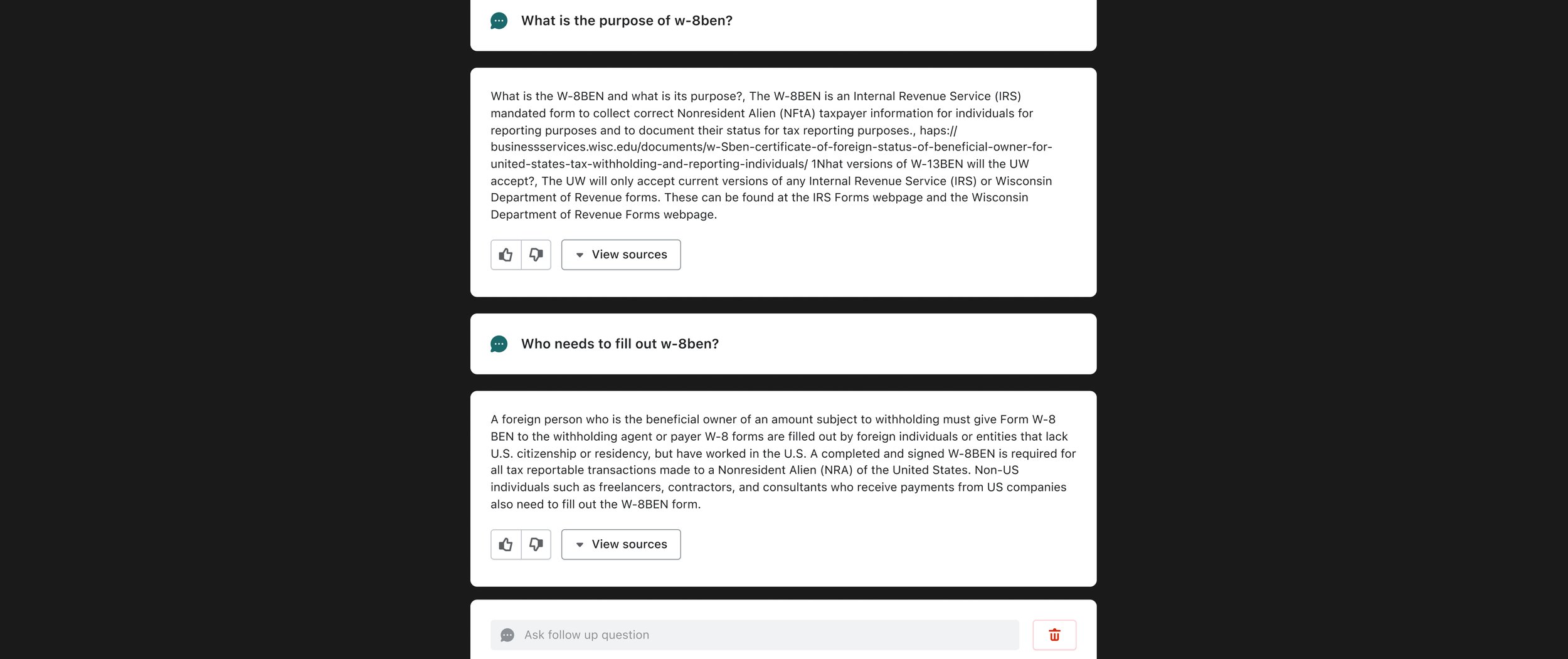

Taby: The tax buddy

Taxglobal had already gathered a wealth of resources and knowledge, accessible through its Resources section. Taby was the cherry on top. An AI-powered assistant that allowed users to ask questions and receive instant answers. Taby didn't just provide answers; it also offered resources for further reading and verification.

Results and impact

Workflow efficiency

By centralising client communications and document management, the platform helped tax professionals reduce administrative time by an estimated 20 hours per month, on average.

Retention

The Customer Portal feature and collaboration tools contributed to a 15% increase in platform retention rates among tax service providers.

Client relationships

Integrated analytics and tracking tools enabled tax professionals to proactively address client needs, with 84% of surveyed users reporting improved client satisfaction.

New revenue streams

The invoicing feature facilitated over $1.2M in transactions during the first quarter post-launch, creating value for both providers and their clients.

Future developments

With the expansion of new users, especially in the service-seekers segment, a need for a native mobile app emerged as the next phase of the product. While maintaining networking as the core element, we aim to bring as many features as possible to a smaller device.

All materials and content related to the TaxGlobal platform presented in this case study are the exclusive property of TaxGlobal Inc. As the designer, I am showcasing this work for the purpose of illustrating my design contributions. All rights, including intellectual property rights, are fully reserved by TaxGlobal.

Cover image template designed by Zlatko Plamenov and downloaded from Freepik.